2020 is off to a big start for U.S. Dollar (USD) strengthening as a mix of continued good economic data and panic elsewhere over trade and disease have boosted the safety of holding USD positions over all else.

The desire to participate in the domestic stock indexes, which are reaching record highs almost daily, has exacerbated the demand for USD from other regions. Ultimately, the resilience here is paying off for the USD and the uncertainty over global growth is not yet denting the American economy in a terrible way.

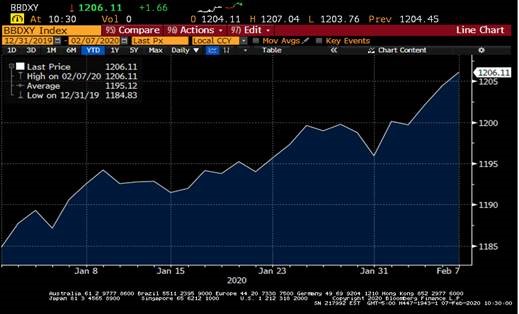

The Bloomberg Dollar Spot Index below exposes the impressive ascension of 1.7% in just over 5 weeks.

Euro

The shared currency is at its weakest point since October 9th. A weaker Germany and France bode poorly for the economic recovery needed for Euro value to climb. Our predictions are for better economic and currency realities as the year progresses, but right now too much contraction is threatening the vision (1.0960, refusing to go below 1.0950 – we believe, its bottom).

British Pound

A defiant Prime Minister in Boris Johnson is fomenting doubt that a good deal can be agreed to between the European Union and the United Kingdom by end of the year. Economic pressures and chances that the Bank of England will need to intervene in markets via more easing are factors contributing to the Pound sinking from its post-election rally (1.2950 – we feel it has room to fall further).

Canadian Dollar

The “Loonie” is at its lowest value since October 10th, owing much of the negative impact to declining oil prices and changing dynamics as China becomes isolated by big companies. Asian activity is key to Australia, which is important for Latin-American ships and the northern companies in charge of cargo. With automotive lines also compromised, the buck just appears safer to investors (1.3305 – we think recovery is certainly possible; hoping no rate cuts).