We have officially passed the half-way mark for 2019, so what have our impressions been so far?

BRL

The Brazilian Real has benefitted from speculation about its potential for growth following the change of the guard last year when Jair Bolsonaro became President, promising a pro-business agenda that would see the elimination of a lot of bureaucracy as well as pension reform. Naturally, his disposition reverberated with investors looking for yield who seek BRL and ended up winners the last 6 months. Thus far in 2019, the currency is up by 3.9% and since mid-May, it has been on a strong recovery rally that has seen it climb by almost 10.0%!

Part of the reason for the appreciation lies on the economic possibilities, but that’s once they are successful. Ultimately, the BRL could see a turnaround next year if Bolsonaro cannot improve the country’s finances and practices. Coming in elected as a different type of leader than previous administrations criticized for deep and evidenced corruption, the President and a few allies, unfortunately, are under investigation for scandals involving possibly illicit funds. Furthermore, the economy is dwindling as Gross Domestic Product is certainly down with GDP for Q4 2018 expanding only 0.1% and later contracting in Q1 2019 at (-0.2%). The yearly average dropped from 1.1% to just 0.5%.

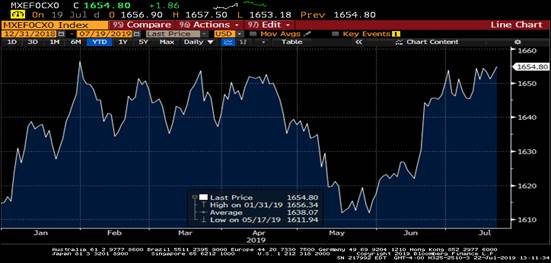

(MSCI WORLD COMMODITY PRICES SINCE MID-2014)

This year’s trade woes can be given credit for also aiding the BRL, a currency driven by the prices of commodities. According to the MSCI World Commodity Index, prices have surged by 8.7% thus far this year, recovering from a 23.0% loss in 2018. Clearly, currencies such as BRL, INR, as well as other emerging market assets benefitted from turbulence in trade dynamics and prices went up to adjust to the threat and implementation of new tariffs. Thus, the MSCI Emerging Market Currency Index is up 2.4% since the start of 2019. Brazil will need to overcome its political-crisis driven tendencies in order to find support and think of thriving, but its currency at the moment is at the highest cost to the dollar since the beginning of March. Watch out for the possible rise of Rodrigo Maia if anything were to happen to Bolsonaro because of legal issues, he’s the most prominent member of congress as president of the chamber of deputies who is succeeding in building a coalition to govern while President Jair defends himself from accusations and the opposition.

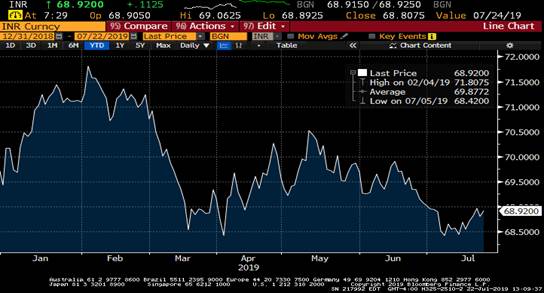

INR

The Indian Rupee is trading about 1.2% stronger than it was when the year started surviving the tumultuous nature of trading changes and challenges to the world order. As much as any other emerging market, India has seen an uplift from the growth in commodity prices and the belief that the country has room for growth. In April and May, the country held general elections and chose to re-elect Narendra Modi as Prime Minister after a tough campaign. Much like Brazil, India is hoping to cut back on the convoluted nature of its bureaucracy, often a cause for delaying major projects and reforms to develop the country’s physical as well as financial infrastructure. Modi’s second term will be a test of how far he can actually change India for the better.

Similar to its neighbor China, India ‘s economy is one of aggressive growth, with Gross Domestic Product figures above most regions. In Q4 2018, the yearly GDP average was 6.7%, but it came down as readings of Q1 growth revealed a decreased annual pace of 5.7%. A lot of this has to do with changes to its economy as India plans to play a bigger financial role and less so a manufacturing one. Surprisingly enough, trade concerns have not slowed down Industrial Production as it has in other regions, with 3.1% currently the pace of annual growth compared 2.5% January 2nd. We see the potential for perhaps even further appreciation for the currency as the Federal Reserve here prepares to use loose monetary policy to stimulate the economy. Once trade resolutions come in the form of a trade deal for Brexit and a revamped pact between China and the U.S. that solves the tariff impasse, INR shall see a bump as commodity-based emerging markets rise from the optimism it’d bring.

(MSCI EMERGING MARKET CURRENCY INDEX)

CNY

On the other hand, the Chinese Yuan is not having a good time. Ever since the end of April when more tariffs were introduced in the “trade war” with the United States, China’s problems have come to light when it comes to difficulty opening up its financial sector to the free market and transitioning from a manufactured-goods-based economy to a services-driven one. Q2 GDP figures for China showed that the world’s second-largest economy is finally hitting the brakes a bit at 6.2%, the lowest quarterly figure in 27 years. While the People’s Bank of China is the responsible authority behind setting the exchange rates, it is clear that China has tried to stay competitive. The fluctuation of the currency will certainly take an immediate turn once diplomatic efforts to improve rules of trade engagement succeed. We have gotten a lot of mixed signals for the last 2 months, with promises of solutions vanishing by the end of talks arranged. We hope for the sake of the economy that we see a healthier commercial partnership moving forward.