NEW YORK, July 7 (Reuters) - A rally in U.S. Treasuries gathered speed on Wednesday, with 10-year yields dropping to a new 4-1/2-month low around 1.30% as doubts over the strength of global economic recovery and the possibility of a COVID-19 resurgence drew in buyers.

Traders said the moves represented an unwinding of large short positions that had built up in U.S. Treasury markets, as many had been betting that the economic rebound would boost bond yields, which move inversely with prices.

COMMENTS

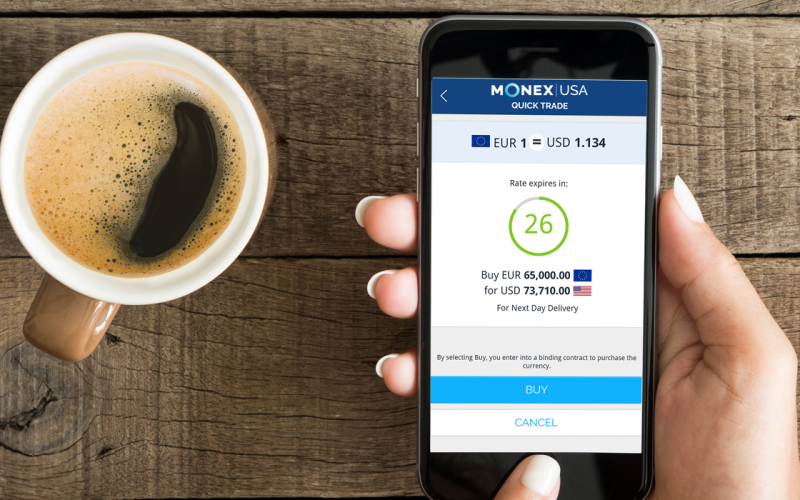

JUAN PEREZ, FX STRATEGIST, Monex INC, WASHINGTON

“I think part of the move in yields is expected because there’s a sense with recent economic data that even if there are some Fed members likely to look towards tapering, the overall policy will stay very loose and uninterrupted because we are not seeing anything indicative of “too hot”.”

“In fact, global risks have gone up, so with doubt over interest rates as well as inflationary growth, the buck could gain and there’s not much behind yields as a booster…the inflation scare was played out.”

TOM SIMONS, MONEY MARKET ECONOMIST, JEFFERIES, NEW YORK

“I think it’s a combination of things, there isn’t really a specific catalyst that I can really identity. A lot of it is going on in futures rather than the cash market, from what I’ve heard. And I’m pretty sure, at least in the 10-year space, some kind of technical level was broken yesterday. That combined with this volatility in oil, I think there are some position shifts that need to go on.”

“I think expectations for growth, for employment and for inflation were all really, really optimistic and now, for whatever reason, there seems to be this reckoning that expectations were a little bit too high, especially on the labor market front. We had payrolls come in above expectations on Friday, but there was a whisper number that was much higher. I think that it was expected to beat expectations by a lot, and it only barely beat expectations. So given the slow progress we’ve seen in claims on a weekly basis, the ISM services employment index was below 50 yesterday for the first time this year, I think that there’s this expectation that maybe we’ve already seen the best part of the recovery and that the rest of this is going to be a slow grind as businesses try to figure out how to do more with less in terms of people, how to become more productive.”

JUSTIN LEDERER, INTEREST RATE STRATEGIST, CANTOR FITZGERALD, NEW YORK

“I think a lot of this is just short covering. The market is leaning to higher rates just given coming out of COVID and the economy reopening and clearly spending and talking of the Fed tapering and lot of expectations especially after the dot-plot move to 2023 that you could see Fed rate hikes sooner than later.”

“I don’t think the market 10’s on out, or even five’s on out, should be at these yields, but it just feels like the short base is being trimmed.”

“The market is not ready to go to higher yields and every little down tick is quickly met with buyers.”

SAMEER SAMANA, SENIOR GLOBAL MARKET STRATEGIST, WELLS FARGO INVESTMENT INSTITUTE, ST. LOUIS

“Probably the biggest change has been around the Fed’s tone with respect to, they acknowledged at the last meeting that they have maybe begun the conversation to start talking about, start talking about taper. Today we have got the Fed minutes so there is probably a little bit of risk that maybe the contents of the meeting were even a little more hawkish than Powell’s comments themselves.”

“Today probably marks an important inflection point for interest rates… The market seems to be pricing in a lot more hawkish Fed then we think will actually be the case. We think they will continue to support the recovery.”

“It’s really been this last month or so that (yields) have taken a sharper turn down and really the only thing that has ‘changed’ is the Fed meeting in mid June.”

BOB DOLL, CHIEF INVESTMENT OFFICER, CROSSMARK GLOBAL INVESTMENTS, HOUSTON, TEXAS

“(The move in the bond market) is a bit puzzling. It’s a function of inflation talk almost disappearing. It’s a function of increased uncertainty in Washington D.C. about the infrastructure bill. It’s a function of…while the economy is very good, the growth is in the process of probably peaking and you club all that together and that’s giving encouragement to bond buyers.”

“The Fed has been pretty clear in their statements. I don’t think there will be anything untoward. Talking about how on the one hand the economy is good but on the other hand we have inflation but they will make the argument that it’s will be transitory. I don’t think there will be any surprises.”