New York, August 20 (Reuters) - The euro broke through the $1.20 mark for the first time since 2018 on Tuesday and the dollar slipped to a multi-year low as investors bet the Federal Reserve’s policy framework meant U.S. rates would stay low for longer.

The euro reached $1.2011 EUR= in North American trade, a 28-month high, but pared gains shortly after.

The Fed’s announcement last week that it would tolerate periods of higher inflation and focus more on employment has encouraged traders to sell the dollar, with the euro the biggest beneficiary.

The dollar typically falls as lower yields on U.S. assets discourage foreign investment.

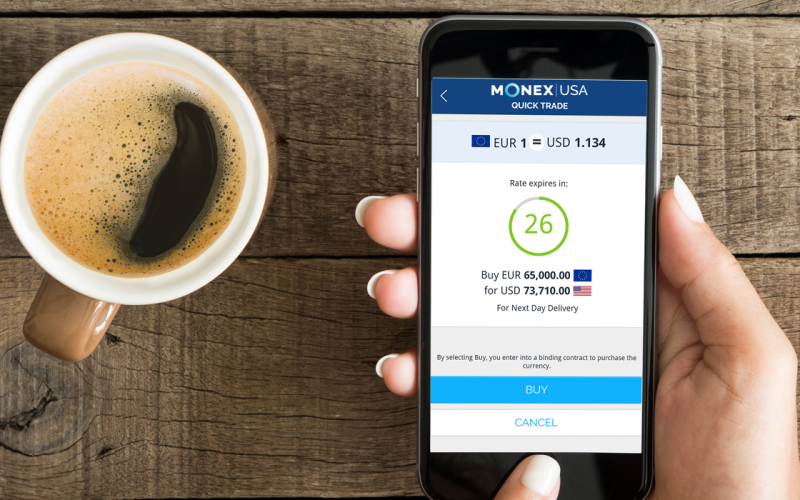

Fed Chair Jerome Powell’s speech from last week on the shift in inflation policy remains a major driver for the dollar this week, said Juan Perez, senior foreign exchange trader and strategist at Monex, Inc.

“What markets are coming to terms with is that there will not be an interest rate incentive (for the dollar) in the near future, which is why you’re seeing the dollar really falling deeply and in a more sustained and consistent way. And why you’re seeing the euro breakthrough.”

The dollar index, which measures the U.S. currency against a basket of rival currencies, was down 0.10% at 92.092 =USD, after hitting its lowest since April 2018.

U.S. political uncertainty ahead of November’s presidential election and concerns about U.S. economic recovery have also weakened the greenback.

In July the European Union passed a landmark 750 billion euro package that supports the countries hardest hit by the pandemic and involves the bloc selling bonds collectively, rather than as individual nations. Since its passage, the euro has risen about 3.7%.

Elsewhere, the Chinese yuan brushed off concerns about diplomatic tension over Taiwan to reach its strongest since May 2019. In offshore markets, the dollar was last down 0.26% against the yuan to 6.830 CNH=.