New York, September 11 (Reuters) - The euro rose for a third straight session against the dollar on Friday, with investors encouraged to push it higher after the European Central Bank showed no sign of stemming the single currency’s appreciation.

At a press conference on Thursday, ECB President Christine Lagarde said the bank is not targeting exchange rates. She also struck a less dovish tone on the euro zone economy, as the ECB lifted its growth forecast for 2020.

After Lagarde’s briefing, sources said policymakers had agreed to look through the euro’s rise, judging it was broadly in line with economic fundamentals.

On Friday, however, ECB policymakers, including chief economist Philip Lane, warned against complacency over low inflation and highlighted risks from a strong euro, nuancing the bank’s benign message from a day earlier.

“There is a feeling here that it’s okay for the euro to be around $1.1750-$1.1850. If it hits $1.1950, it probably starts swinging down,” said Juan Perez, currency trader at Monex Inc in Washington.

“Overall, ECB policymakers seem to be saying that let’s not overreact about the euro exchange rate,” he added.

In mid-morning trading, the euro rose 0.3% to $1.1840. It reached $1.1917 on Thursday, a one-week high.

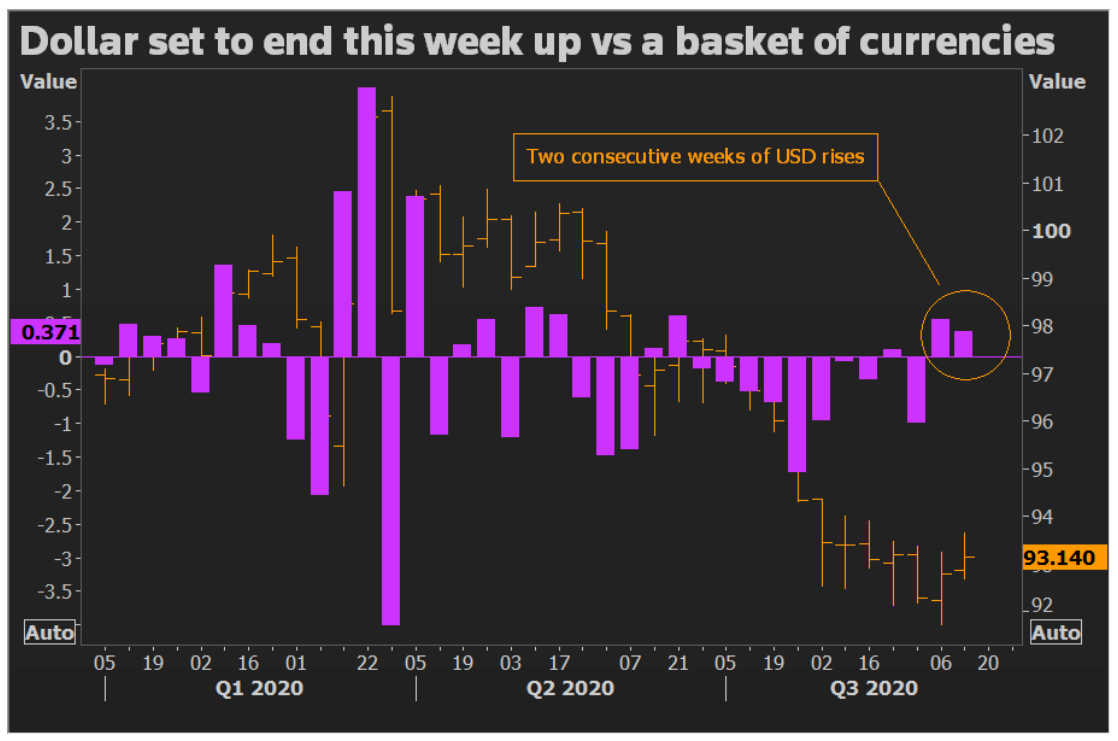

The dollar index, which tracks the greenback against other major currencies, slipped 0.1% to 93.277. The index though was poised for a second week of gains.

The dollar was little changed against the yen at 106.12 yen.

Data showing a rise in U.S. consumer prices last month had little impact on the dollar.

The Labor Department said on Friday its consumer price index rose 0.4% last month. The CPI advanced 0.6% in June and July after declining the prior three months as business closures to slow the spread of the coronavirus depressed demand.

“When market participants compare the tone of the ECB

with the Fed’s formal shift to allow greater inflation, the market remains encouraged to sell the dollar,” said Derek Halpenny, head of research at MUFG.

“But the euro/dollar correction back from 1.1900 after the ECB press conference does indicate that dollar selling may still have reached its limits for now,” Halpenny said.

Elsewhere, the pound slipped 0.1% against the dollar to $1.2792 , and sank to a fresh 5-1/2-month low of 92.90 pence versus the euro, adding more losses after the heaviest sell-offs seen this year sent the pound falling nearly 2% against the euro on Thursday.

As the Brexit saga intensifies, sterling was on course for its worst week since March when forex markets were going through a coronavirus-induced turmoil.