Feb 20 (Reuters) - Latin American currencies took a beating on Thursday, as investors feared a bigger hit to global growth from the coronavirus outbreak after cases outside of China rose.

- Brazil posts lowest monthly February inflation since 1994

- Coronavirus buoys safe-have demand for U.S. dollar

- Argentine bonds fall after IMF nod for restructuring

The Brazil’s real hit a new low amid improving safe-haven appeal for the dollar as data pointed to strength in the U.S. economy, while the Mexican and the Chilean pesos fell more than 1.3%. The number of new infections rose in South Korea, while Japan reported two new deaths and new research suggested the pathogen was more contagious than previously thought, adding to the alarm. The dollar was perched at a 10-month high against the Japanese yen after rising nearly 2% since Tuesday, while also upping pressure on Latin American currencies.

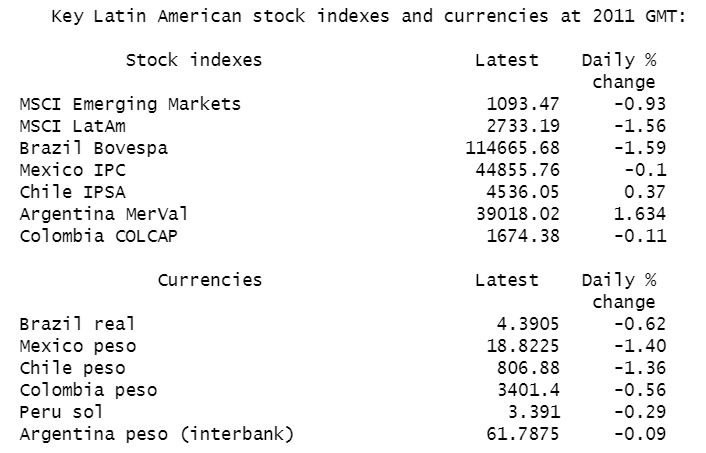

Brazil’s real weakened 0.6% to 4.3905 against the greenback, touching a fresh record low. Data showed Brazilian inflation slowed in February to its lowest in over a quarter of a century. The central bank of Latin America’s biggest economy said it would lower banks’ reserve requirements on time deposits to 25% from 31%, starting on March 16, in a move that will free up an estimated 49 billion reais ($11.2 billion) of liquidity.

“Overall, it seems like there is a sense of necessity for central banks to look towards easing. Since the numbers have not been upbeat in Brazil, it only looks poorly for the currency,” said Juan Perez, senior foreign exchange trader and strategist, Monex Inc. “The real, however, has potential to recover dramatically once this coronavirus situation is overcome.”

A basket of currencies in the region weakened by 0.6%, while MSCI’s index for Latin American equities fell 1.6%. Brazilian shares also dropped 1.6%, with conglomerate Ultrapar Participações SA leading declines after a one-time charge in its drugstore chain Extrafarma hit quarterly earnings. Meanwhile, airline Gol, Boeing Co’s largest Latin America customer, fell 5% after reporting a quarterly profit that almost halved as its MAX fleet remained grounded after two deadly crashes.

State-run oil firm Petroleo Brasileiro SA slid 1.8% after executives said its oil exports should fall slightly in the first quarter and production is already taking a hit, due to scheduled maintenance stoppages. Argentine bond prices fell 1.3% after the International Monetary Fund essentially gave the government a green light to restructure its bonds.

The question is how much of a haircut private creditors will be asked to take in the upcoming bond revamp. Economy Minister Martin Guzman has said he wants to avoid a rancorous restructuring but vows to neither make unsustainable debt payments nor impose fiscal austerity.