NEW YORK, Mar 10 (Reuters) - Latin American currencies clawed back some losses on Tuesday, a day after falling to historic lows, fueled by a rebound in oil prices and hopes for more stimulus.

- Major Latam currencies come off lows

- Bets fall for Banxico rate cut

- Brazilian industry kicks off 2020 with solid rise

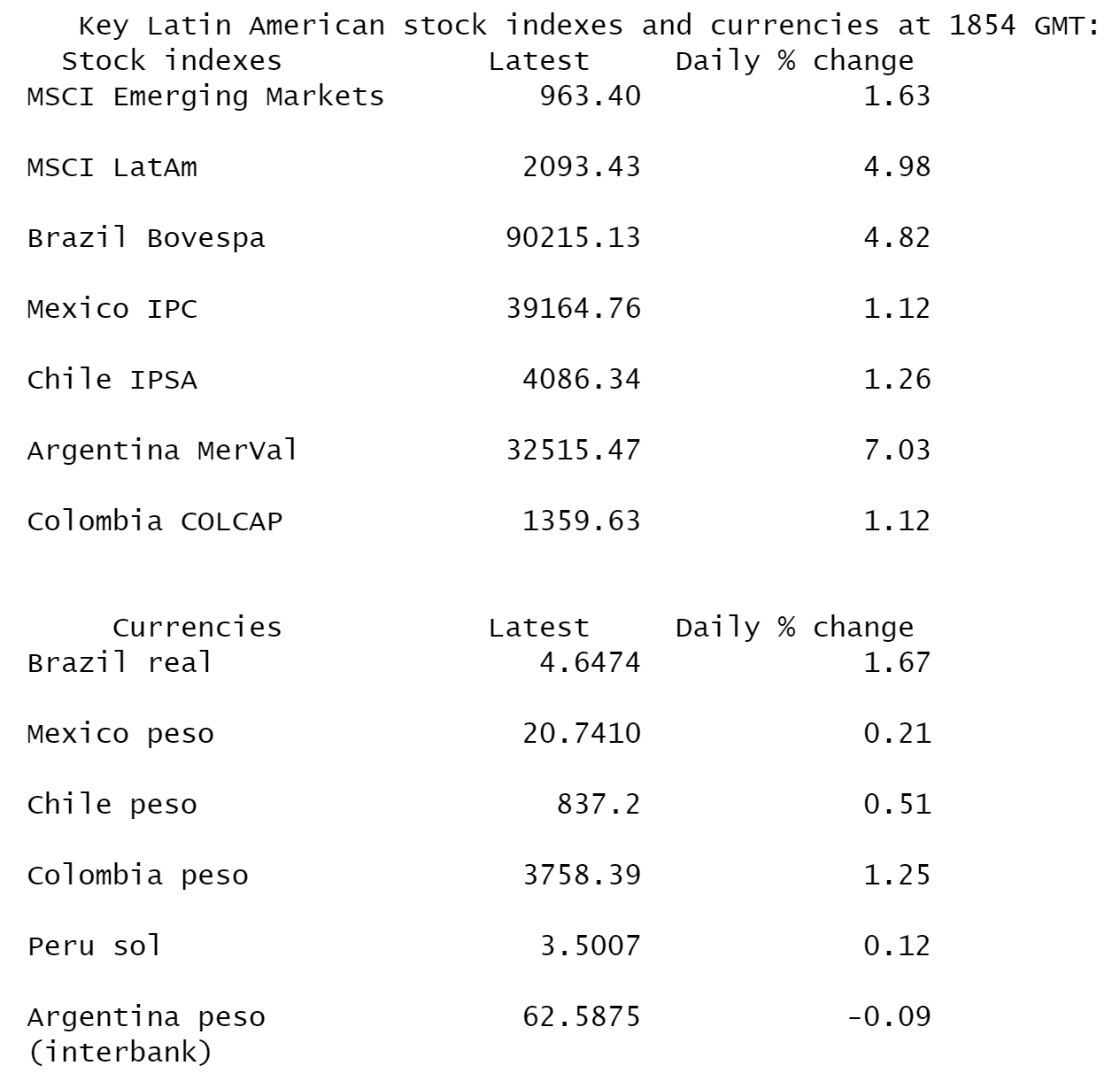

Currencies of Brazil, Chile and Colombia came off all-time lows hit last session, but still hovered near hose levels. They rose between 0.5% and 1.6%.

U.S. President Donald Trump on Monday promised “major” steps to combat the virus outbreak and said he would discuss a payroll tax cut with congressional Republicans.

“There’s a bounce and that emanates from a feeling that stimulus all across the board will lead to increase in global demand and give emerging markets a break,” said Juan Perez, Senior Foreign Exchange Trader and Strategist at Monex, Inc.

Mexico’s peso traded 0.1% higher, with investors taking comfort from the country’s currency commission move to increase foreign exchange auctions to $30 billion from $20 billion.

Banxico, as Mexico’s central bank is known, has two weeks to decide whether to reduce lending rates for a sixth consecutive time. The move is seen as less likely after the peso hit an all-time low of 22.929 per dollar on Monday.

“There’s got to be more calm in exercising loose monetary policy especially when the recessionary pressures may not have yet manifested themselves. Cutting seems pre-emptive and preventative and may not be the best approach,” Monex, Inc.’s Perez added.

The Mexican and Colombian pesos had tumbled after Saudi Arabia and Russia sparked an oil price war, but an 8% rebound in crude prices on stimulus hopes soothed the market.

Concerns linger about a likely economic downturn as the fast-spreading coronavirus has infected over 100,000 people.

Brazil’s Treasury has canceled this week’s scheduled auction of fixed rate bonds, citing “more restrictive financial market conditions,” it said on its website late on Monday.

Sao Paulo’s Bovespa stock index jumped 4.8% after posting its worst day since 1998. The rebound in oil and higher iron ore prices lifted Petrobras and Vale shares, respectively.

Adding to the optimism, data on Tuesday showed Brazilian industry got the year off to a solid start, with output rising in January for the first month in three and at its fastest pace since August.