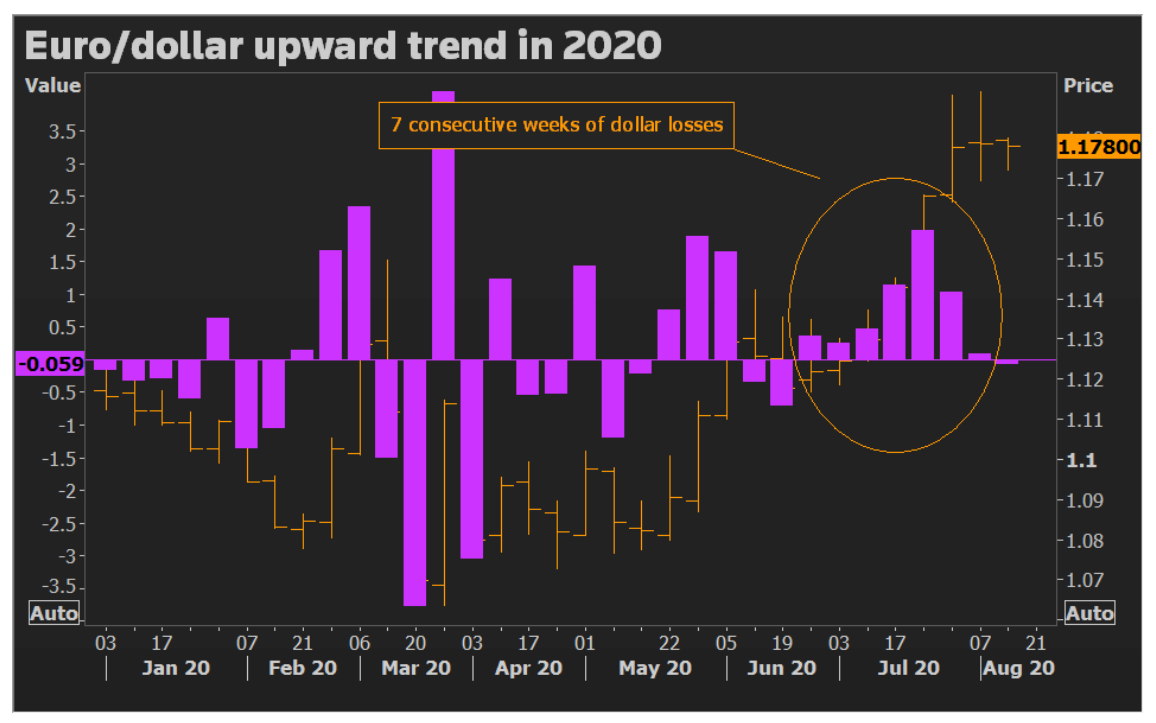

NEW YORK, Aug 11 (Reuters) - The dollar fell from one-week highs and the euro topped $1.18 on Tuesday as investors flocked to currencies that benefit from an improving global market outlook, with the S&P 500 nearing a record high and investor sentiment in Germany rising more than expected.

Aside from the euro, sterling and commodity-linked currencies such as the Australian and Canadian dollars, as well as the Norwegian crown, gained against a broadly weakening dollar.

“Europe’s political and economic situation in terms of dealing with the pandemic has become far more stable than that of the United States,” said Juan Perez, senior currency trader at Monex Inc. in Washington.

“No matter how gradual the recovery may seem in the U.S. and even though the economic indicators may be positive, the reality is that the United States has not handled COVID well and the economic shutdown has created an uncertainty difficult to move away from,” he added.

In early afternoon trading, the dollar index =USD was down 0.1% at 93.503, sliding from a one-week high hit earlier in the session.

The euro rose after the ZEW survey of economic sentiment rose to 71.5 from 59.3 the previous month, far exceeding a forecast for 58.0 in a Reuters poll of economists.

As a result, euro/dollar hit a high of $1.1809 EUR=EBS. The move was exacerbated by thin August liquidity, said Jane Foley, senior currency analyst at Rabobank, and she was “suspicious” about how much effect the ZEW survey had.

The euro was last up 0.2% at $1.1763.

“We need to wait ‘til September to see clear direction coming from euro/dollar,” Foley said.

The U.S. dollar has held a floor, despite losses, amid U.S.-China tensions and a stalemate between Congress and the Trump administration over fiscal stimulus.

The U.S. currency, however, hit a three-week highs against the yen JPY=EBS, as U.S. 10-year Treasury yields rose to four-week peaks US10YT=RR.

Congressional leaders and administration officials said on Monday they were ready to resume negotiations on a coronavirus aid deal. It was unclear whether they could bridge their differences.

Meanwhile, China imposed sanctions on 11 U.S. citizens, including Republican lawmakers, following Washington’s sanctions on Hong Kong and Chinese officials.

U.S. Treasury Secretary Steven Mnuchin said companies from China and other countries that do not comply with accounting standards will be delisted from U.S. stock exchanges as of the end of 2021.

Market response to the U.S.-China conflict has been limited, but analysts say there could be longer-term implications.

Sterling traded up 0.1% at $1.3088 GBP=D3 after Bank of England Deputy Governor Dave Ramsden said the central bank will step up quantitative easing if the British economy struggles again.