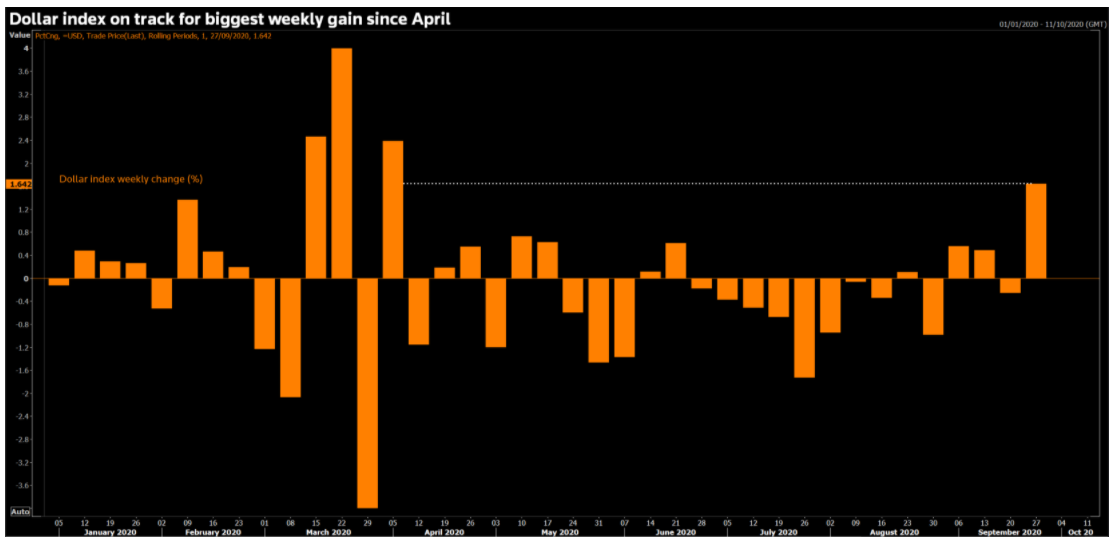

New York, September 25 (Reuters) - The dollar extended its gains on Friday and was on track for its biggest weekly gain since early April, as investors sought safety amid a slowing economic recovery, rising coronavirus infections in Europe and uncertainty surrounding the upcoming U.S. elections.

While orders for key U.S.-made capital goods increased more than expected in August, orders for durable goods – ranging from toasters to aircraft that are meant to last three years or more – rose 0.4% in August after jumping 11.7% in July.

While the dollar fell slightly on Thursday, for the first session in five, as equities rose on hopes for U.S. stimulus, the greenback’s rally resumed on Friday as worries resurfaced.

“Yesterday was a calmer more positive sentiment … then this morning’s durable goods show that the pace of growth in the United States is very uneven,” said Juan Perez, senior currency trader and strategist at Monex Inc.

Along with weaker U.S. and overseas economic data and expectations, Perez said dollar demand was also boosted by Washington’s failure to create a stimulus package and concerns ahead of the U.S. election.

Top Republicans on Thursday repudiated President Donald Trump’s refusal to commit to a peaceful transfer of power after Trump, also a Republican, said Wednesday that he expects the election result to end up being settled by the Supreme Court.

“In times like that when the chaos and havoc and blurriness of the future is so intense and so dense, that’s when the dollar is going to rise once again,” said Perez. “Markets are always going to be afraid when a strong government does not give clarity about continuance, about stability.”

Currency moves were closely correlated with share indexes, which have fallen sharply this week as markets re-evaluated the shape of a possible recovery from the pandemic.

The dollar index, which measures the greenback against a basket of major currencies, was last up 0.35% at 94.642 and was on track for its best weekly percentage gain since April 5th.

“The dollar is doing well under risk-aversion conditions and lower asset prices – not to the same extent that we saw in March/April but certainly enough to take notice,” said Neil Jones, senior director and head of FX sales at Mizuho..

The euro was down 0.4% at $1.1625 , close to two-month lows hit on Thursday.

Riskier currencies fell, with Australian dollar lower 0.3% on the day and set to end the week down around 3.6%, in its biggest weekly decline since March. The New Zealand dollar was down 0.15% against the greenback.

The yen was lower against the dollar at 105.65.