(Reuters) The euro fell on Thursday as European Central Bank President Mario Draghi, while acknowledging faster growth in Europe, said regional inflation remained subdued and rising protectionism is a risk.

With the ECB in the rear-view mirror, traders await news from the Bank of Japan’s policy meeting and the U.S. government’s payrolls report for February.

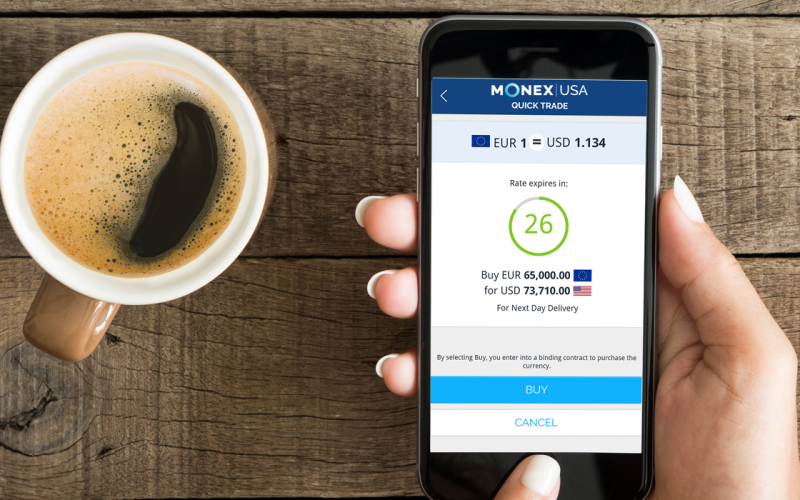

“We think that they will not make any changes. Inflation is ticking higher but under their target,” said John Doyle, vice president of dealing and trading at Monex Inc in Washington.