Movements in currency markets were muted overnight and we also expect a quiet session today.

Overview

Many of the G10 countries are shutdown today for Good Friday and Monday for Easter. With most traders away from their screens, there is little liquidity in the markets today.

While U.S. equity markets are also closed, we will be keeping a close on the release of March Non-Farm Payrolls at 8:30 EST. Economists estimate the U.S. added 650K jobs last month as the economy opens back up on the back of an impressive vaccine rollout. A better-than-expected number could push Treasury yields higher and counterintuitively send equity futures lower which would benefit the greenback.

TEMPUS will be open normal Friday business hours, closing when markets do at 5 p.m. EST.

What to Watch Today…

- Non-Farm Payrolls at 8:30 a.m.

JPY ⇑

Japan is one of the few G10 markets that are open today. Nevertheless, USD/JPY movements are also muted. The yen weakened to its worst level in 13 months yesterday but has regained some of those losses overnight. Perhaps the U.S. labor report can affect risk enough to move the USD/JPY pair but a quiet session is the most likely scenario.

CAD ⇑

Canadian markets are also closed today for Good Friday. The loonie initially strengthened overnight but has since given back its modest gains. The initial boost stronger correlates to higher oil prices. Crude popped higher despite OPEC+ agreeing to increase production gradually over the next three months. While more supply should help keep prices from rising too far, the proposed increase was only marginal.

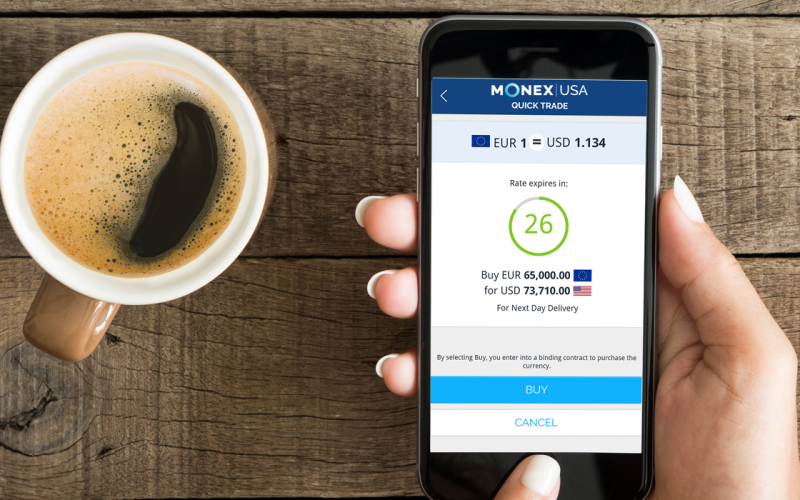

Ready to spin the currency market moves in your favor?

Discover HOW WE Can HELP You SEND or RECEIVE PAYMENTS