The U.S. dollar was beaten up during yesterday’s session, reaching new multi-year lows against a number of its counterparts.

Overview

A “risk-on” day accelerated mid-morning on news that the COVID stimulus bill could be passed in the coming weeks sending stocks soaring at the expense of the greenback.

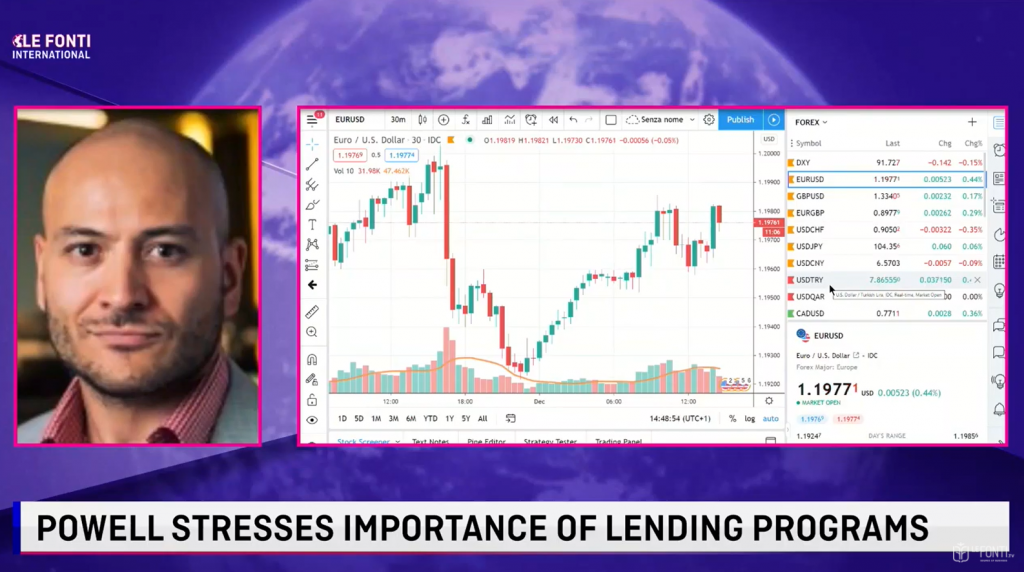

Risk sentiment has pulled back slightly overnight but the dollar still remains in rather weak ranges. The dollar touched its worst level in 2.5 years versus the Euro and New Zealand dollar yesterday and breached its worst level since January 2015 versus the Swiss franc this morning.

This morning’s private payroll data was disappointing. ADP said that only 307K jobs were added to the private sector in November, missing estimates of 446K. The data could foreshadow a weaker than expected Non-Farm payroll print on Friday and might be more evidence that the economy’s expansion is under threat as Covid cases rise again. Later, the Federal Reserve will release its Beige Book.

Fed Chairman Powell will be testifying before Congress again today. We expect him to maintain that the economy remains in a fragile state amidst the rise in Covid cases and deaths.

What to Watch Today…

- No major events scheduled today

View this month’s Economic Calendar

Hear Juan Perez, Senior FX Strategist, deliver the latest in currency news from Powell’s remarks to the future of bitcoin. Listen now

EUR ⇓

The Euro raced to a two and a half year high against the U.S. dollar and extended those gains in early trading. EUR/USD ceded some ground to open today’s session and the pair may be trying to establish new, higher ranges. The last time the Euro broke above this psychological level, the European Central Bank was quick to talk down the currency’s strength. So far, we have not heard a peep.

If the ECB is comfortable with a stronger Euro, the question becomes how far can the Euro run? The 2018 high is about 5 cents (or 4%) higher than current levels. While we believe that is not the likely scenario in the near-term, it has our attention.

GBP ⇓

While most currencies continued to march higher or hold gains against the dollar, the sterling was the rare exception. The pound came under pressure after EU Chief negotiator Michel Barnier said that the outcome of any negotiation is still too close to call. While we have seen reports of progress between the two sides, both sides are coming under increased pressure to secure a deal by this weekend.

These talks started in March, and deadlines have come and gone. But officials seem to agree that this week is the absolute deadline to give both U.K. and the EU parliaments time to ratify any agreement before Britain crashes out of the EU on December 31st. Expect GBP/USD to ebb and flow with headlines.

Ready to spin the currency market moves in your favor?