The U.S. Dollar continues to dwindle to close the week at its weakest point since April of 2018, according to the Bloomberg Dollar Spot Index.

Overview

Data this morning did not make a strong case for the buck as the Employment Situation shows the struggle to get people back to work as the pandemic only exacerbates, regardless of vaccine news. Change in Non-Farm Payrolls came in way below expectation at 245K instead of 460K. Average Hourly Earnings only increased by 0.3% and the Unemployment Rate remained steady at 6.7%. Meanwhile, we are waiting to hear if Congress will indeed agree to a fiscal deal spending less than $1.0 trillion to help the economy.

Factory Orders are in at 10PM along with Durable Goods Orders, which should expand 1.3%. Any fundamental economic indicators failing to meet estimates will only put further pressure down on the greenback as traders as well as investors look to expand their riskier holdings. We cannot foresee the buck getting a break next week unless developments across the Atlantic turn sour when it comes to Brexit and the ongoing battle in giving money to stubborn member nations.

What to Watch Today…

- No major events scheduled for today

View this month’s Economic Calendar

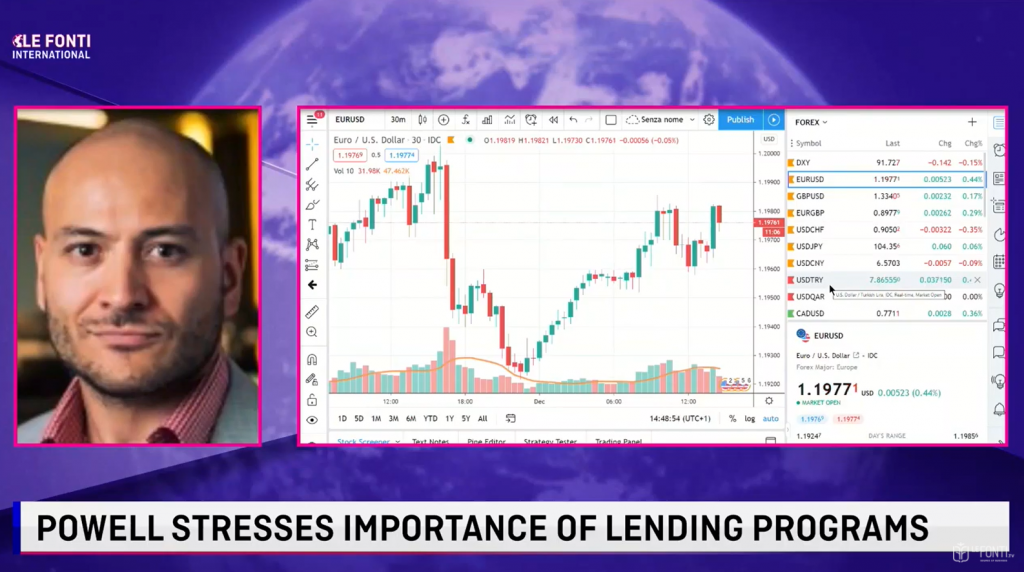

Hear Juan Perez, Senior FX Strategist, deliver the latest in currency news from Powell’s remarks to the future of bitcoin. Listen now

EUR ⇑

The Euro has experienced a formidable run this week based on the positive outlook for 2021, even though December is marked by lockdowns and slowness. Nothing is substantially better in Europe, in fact, we keep getting soundbites of national problems within the EU as Spain and Italy confront very tired public and budget questions. We shall see how Friday evolves as markets react to the very disappointing pace of progress in the U.S. Labor sector.

MXN ⇑

The Mexican Peso is trading at its strongest point since March 5th, which also happens to be the date when the current WTI crude was last at above $46.0/barrel. OPEC+ made a decision to ease it production cuts, which have been a feature in the past year to cope with a glut in the supply of oil. The prospect of an improved economy in 2021 as the globe flourishes is helping lift MXN and other emerging market currencies, but the oil production development certainly helps correlate MXN and WTI once more exacerbating the positive effect.

Ready to spin the currency market moves in your favor?